Colibri Real Estate Career Hub

Grow your appraisal and real estate career with tips, trends and other insights.

Featured

Keep up on the Latest Industry Trends and Best Practices for Real Estate Professionals

-

Review: RISMedia’s September 2020 Digital Magazine

At Colibri Real Estate, we want our customers to have all the resources they need to be successful…

-

Building Your Real Estate Personal Brand as a New Agent

New real estate agents can often get caught up in the myriad of details that go into entering…

Real Estate News

The latest real estate news, advancements and market information.

-

Real Estate Market Corrections Have Led Some Home Buyers to Believe They Overpaid

Those who bought their homes when the market was hot might fear they overpaid. Here is what to…

-

Rental Pricing Up Overall, But Leveling Out Pricing Might Be a Good Sign for Purchase Market

Rental prices have risen an incredible 20% over the past three years, but earnings have only risen 10%.…

-

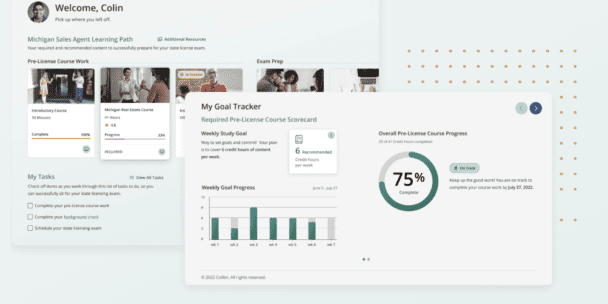

Colibri Real Estate Launches New Interactive Learning Platform for Aspiring Real Estate Professionals

Colibri Real Estate recently announced the launch of a new interactive learning platform for aspiring real estate professionals.…

-

Federal Reserve Mortgage Rates, What’s Next?

Financial trends have been a common discussion topic across all sectors over the past few months as consumers…

Real Estate Career

Find information to help you advance your real estate career and gain new skills.

-

8 Budgeting Tips for Real Estate Agents

If you are like most real estate agents, your income is commission-based, which means it varies from month…

-

How Much Can You Make as a Part-Time Real Estate Agent in 2024?

Considering delving into real estate as a side hustle or a part-time gig? The allure of a part-time…

-

10 Prospecting Tips to Generate More Real Estate Leads in 2024

As a new agent, you can’t just count on referrals, word-of-mouth, and marketing and promotional efforts. To get…

-

10 Tips to Win a Real Estate Listing in 2024

Real estate is a competitive industry. You must learn how to set yourself apart from other agents in…

Real Estate Tips

Practical guidance on what it takes to become a real estate agent.

-

8 Budgeting Tips for Real Estate Agents

If you are like most real estate agents, your income is commission-based, which means it varies from month…

-

Wholesale Real Estate: What Is It And How Does It Work?

There are many ways people make money in real estate. If you have a lot of contacts interested…

-

Listing Agent vs. Selling Agent: What’s the Difference?

The vocabulary of real estate can be tricky. For example, depending on their role, a real estate agent…

-

How to Write a Real Estate Listing Description that Converts into Sales

Writing a winning real estate listing can make all the difference in attracting potential buyers. The strength of…